4 Which of the Following Best Defines Risk Management

The quantum of such risks depends on the type of financial instrument. Chapter 4 - Enterprise Risk Management and Related Topics 36 Terms.

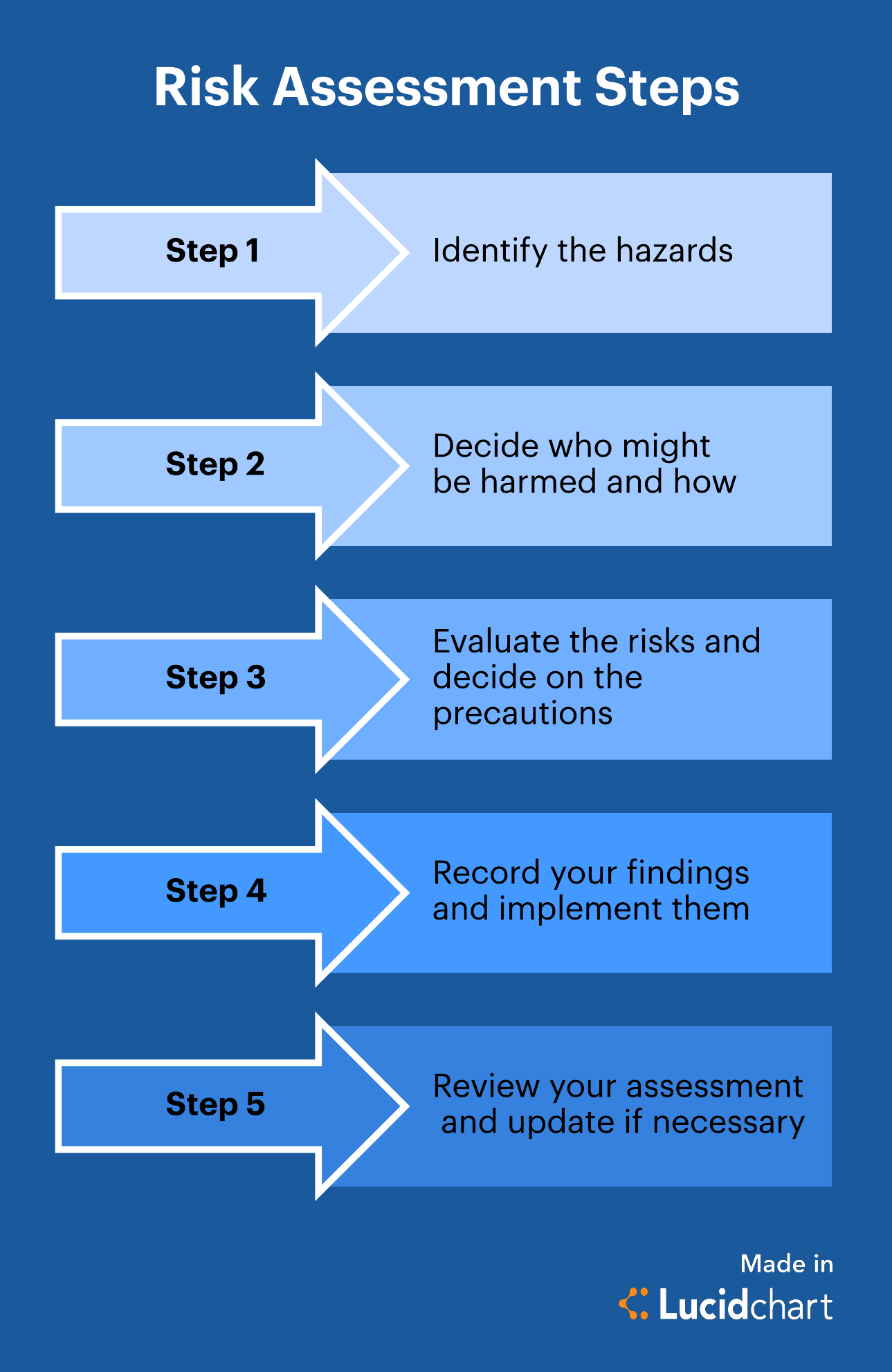

A Complete Guide To The Risk Assessment Process Lucidchart Blog

2 Risk management focuses on identifying and assessing the risks to the project and managing those risks to minimize the impact on the.

. Threats x vulnerability x asset value x control gap. These risks stem from a variety of sources including financial uncertainties legal liabilities technology issues strategic management errors accidents and natural disasters. 1-Rare 2-Unlikely 3-Possible 4-Likely 5-Almost certain.

A risk assessment technique such as the probability and impact matrix. An introduction to the conditions of the project and an outline of the potential risks. Financial risks such as cost of claims and liability judgments.

A description of each risk its risk rating and a mitigation plan. Risk Management Process Definition. Examples of potential risks include security breaches data loss cyberattacks system failures and natural disasters.

The part of the statement which suits the definition of risk analysis is on the the probability that the loss will happen and alternatives for dealing the risk. Effective risk management means attempting to control as much as possible future outcomes by acting. Evaluate or Rank the Risk.

Risks can come from various sources including. Risk management is the process of identifying assessing and controlling risks arising from operational factors and making decisions that balance risk costs with mission benefits. Because of the varying perspectives that senior managers incorporate into their business structure strategy there are always different ways to accomplish the same.

1 risk factor for getting lung cancer and the risk only increases the longer that people smoke. Loss may result from the following. The priority of the risk can be evaluated by combining the effects of likelihood probability and the impact of consequences.

Risk is the possibility of loss or injury. Test 4docx - Question 1 Risk management is defined as the dangers that we seek to actively identify confront and control Selected Answer Question 2 In Course Hero. Communications underpin the entire risk management process and should be ongoing throughout the life of a risk management action or strategy.

How Business Works Chapter 11 37 Terms. If the cost of risk reduction outweighs the potential cost of an incident occurring you will need to decide whether it is really worthwhile. Risk management encompasses the identification analysis and response to risk factors that form part of the life of a business Business Life Cycle The business life cycle is the progression of a business in phases over time and is most commonly divided into five stages.

You develop an understanding of the nature of the risk and its potential to affect project goals and objectives. Once risks are identified you determine the likelihood and consequence of each risk. What is risk management.

Settling the risk management system. Which of the following best defines risk management. Additionally the US.

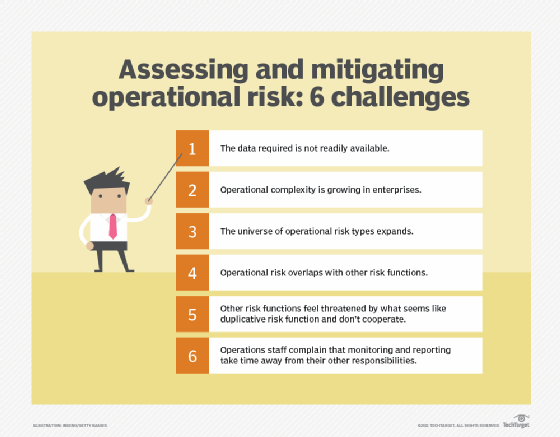

Unlike most managerial systems risk management doesnt overlap with other. 1 Project risk is an uncertain event or condition that if it occurs has an effect on at least one project objective. It starts with the identification and evaluation of risk followed by optimal use of resources to monitor and minimize the.

Assuming that the 4 statements given above are the choices the first statement best defines Risk Analysis. Risk management is the identification evaluation and prioritization of risks defined in ISO 31000 as the effect of uncertainty on objectives followed by coordinated and economical application of resources to minimize monitor and control the probability or impact of unfortunate events or to maximize the realization of opportunities. Linda Tucci Linda Tucci Industry Editor -- CIOIT Strategy.

A list of general information such as the plans status creation date and uploaded date. Literally speaking risk management is the process of minimizing or mitigating the risk. Single Loss Expectancy SLE x Annualized Rate of Occurrence ARO C.

Risk Management - A Basic Understanding. Describe the difference between the business risk of the organization and project risk. It stands out by analysing the events that have never materialized within the organization.

The risk management process relies on effective communication mostly at the beginning of the DHS Risk Management Cycle. One of the best methods of risk management is transferring that risk to another party. OTHER SETS BY THIS CREATOR.

Terms chapter 1 bank management 8 Terms. In business risk management is defined as the process of identifying monitoring and managing potential risks in order to minimize the negative impact they may have on an organization. Threats x vulnerability x asset value.

In the world of finance risk management refers to the practice of identifying potential risks in advance analyzing them and taking precautionary steps to reducecurb the risk. Operational risks such as labor strikes. When an entity makes an investment decision it exposes itself to a number of financial risks.

A process of identifying the potential. The probability of occurrence or likelihood can be based on the 5 scale framework. 12 Risk management mandate and strategy Next.

Words meaning in Arabic chapter 1 bank management 22 Terms. Risk reduction strategies need to be weighed up in terms of their potential return on investment. I hope this helps you.

Risk management is the process of identifying assessing and controlling threats to an organizations capital and earnings. Risk management is an organizational model aimed at developing the quality of management processes. This information is also input to your Project Risk Register.

Similarly the impact of consequences can be scaled on. Centers for Disease Control and Prevention notes that smoking is the No. Risk management is the continuing process to identify analyze evaluate and treat loss exposures and monitor risk control and financial resources to mitigate the adverse effects of loss.

Enterprise Risk Management Erm

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Comments

Post a Comment